As the Head of Vintage New York office, Yaroslaw decided to have a closer look into the fast-paced world of luxury brands in person. He gets to acquaint with the most diverse and exceptionally captivating personalities. Yaro encounters professionals with careers to covet and lives to write books about. We thought a book is quite a way away. So we cherry-pick the insights and share them with you meanwhile.

Michael Pace is another marketing guru who Yaro caught up with in his quest for insights into luxury. This time his field of expertise comes from a rich background in gold, diamonds, and jewelry marketing. Sparkling credentials indeed.

Michael Pace started off his career path in consumer packaged goods and spirits marketing and ultimately moved on to the jewelry industry in 2001. After 13 years with World Gold Council in different roles, including VP of Marketing USA and Global Head of Marketing, he switched his focus to the diamond industry and has been consulting for Diamond Producers Association (DPA).

The Association itself appeared only recently, in May 2015, by seven of the world’s leading diamond producers. The goals were to “enhance consumer demand in diamonds” as well as “ensuring the long-term sustainability of the sector.” Indeed as in every other industry, the sector now has to adapt to the millennial consumption patterns and buying behaviors as well as to the onset of the digital era.

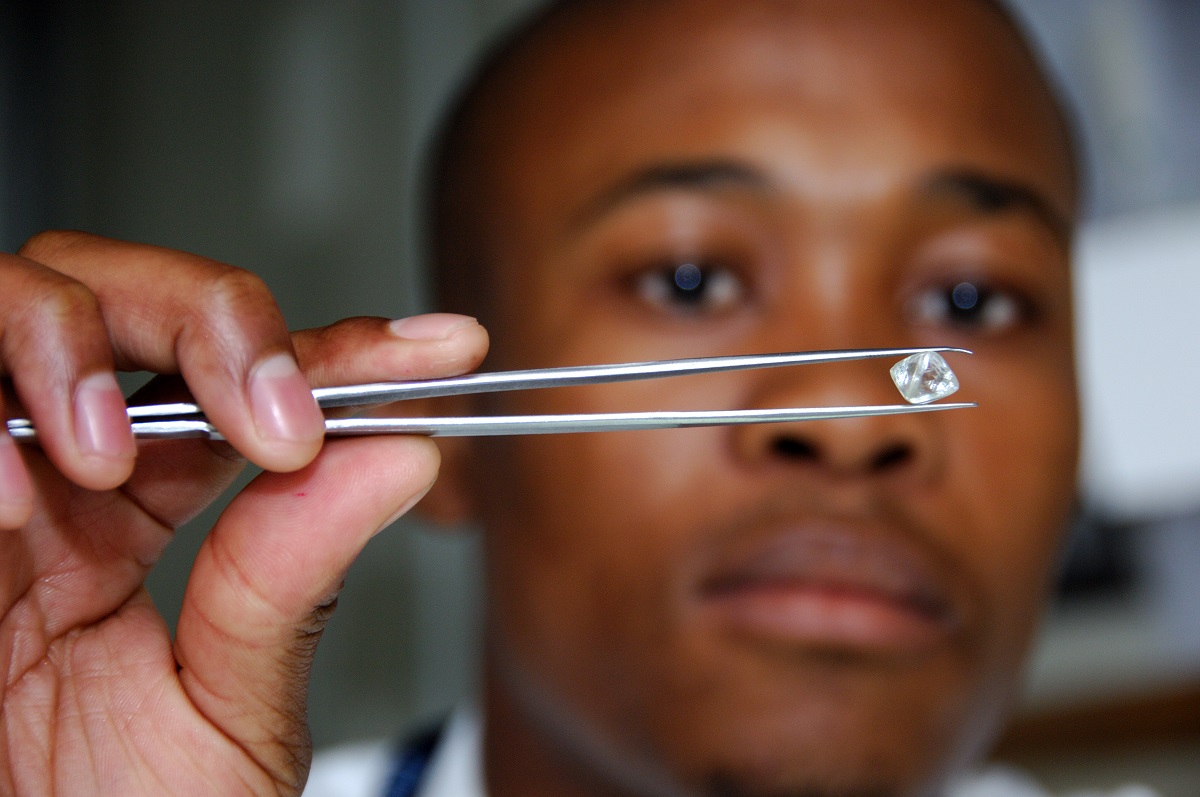

Image credit: Diamond Producers Association. Diamond sorting at DTC Botswana

Image credit: Diamond Producers Association. Diamond sorting at DTC Botswana

The diamond industry has a huge history and quite a significant share of luxury spending. There are a few challenges the sector faces with the evolution of synthetic diamond manufacturing, a shift in marriage age, and languid demand in China. Enjoy following this brilliant conversation below.

YN: What are the trends in diamond demand? Are millennials changing the industry?

MP: Millennials are impacting the industry because of their sheer numbers. They are already bigger than the boomer generation. By 2025, along with Generation Z, they will account for 45% of the global luxury personal goods market according to Bain. Their full impact on the diamond market is still a little way off though for a couple of reasons.

Firstly, many don't yet have a great deal of disposable income yet to buy diamonds, as they are paying off education debt and recently acquired mortgages. Secondly, people are getting married later, if at all. The marriage age is going up and now it's approximately 29 for women and 27 for men versus early 20’s in the 1960’s. So this delay in the engagement ring purchase is affecting sales.

But on the upside, De Beers have observed how consumers are also being exposed to diamonds at younger ages as gifts from relatives and have helped establish aspirational relevance. Millennials are also highly tuned into the world of social media and diamonds are still very much a feature of the Oscars and similar high-end events.

Millennials are keen to show they are individuals. And DPA research showed they had some aversion to formal customs and traditions. You would be forgiven for imagining that this would negatively affect sales of diamonds but we found that once they do decide to get married they buy into the enduring symbolism of romance. “A Diamond is Forever” is therefore still a relevant and motivating proposition.

Individuality also extends to the process of buying a diamond as millennials often want to have a diamond set in a personalized way. That is why retailers should strive to let customers get involved in the process of creating jewelry, and particularly the engagement ring. Those retailers who do this are taking market share.

The creation and celebration of experiences is key to a generation that defines itself by what it does rather than what it owns. This is where diamonds are expanding their emotional territory. These experiences include significant moments where a relationship moves forward, like celebrating the first vacation together or the first job.

The role of diamonds as a celebration of these moments is where potential future growth lies. The industry needs to define these moments and show that only a diamond is worthy of them. The campaign launched by the DPA "Real is Rare. Real is a diamond" starts to explore this territory. The diamond represents an authentic moment in a relationship that is worthy of celebration in itself.

Image source: Diamond Producers Association, Real is Rare video

Image source: Diamond Producers Association, Real is Rare video

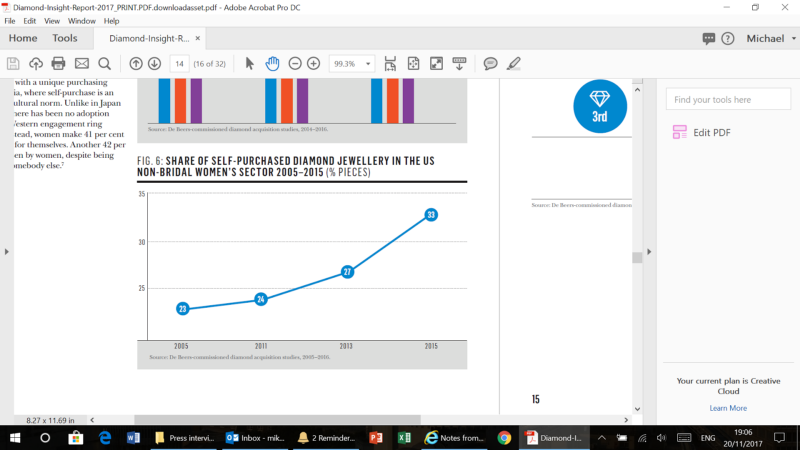

Self-purchase of diamonds is also growing as women are achieving higher levels disposable income. In 2025, more than 50% of households will have a woman as the major provider. According to De Beers acquisition study, the share that self-purchased diamond jewelry had of the non-bridal women’s sector increased drastically from 23% in 2005 to 33% in 2015.

Image credit: De Beers Diamond Insight Report 2017

Image credit: De Beers Diamond Insight Report 2017

In societies where there are social changes taking place, such as upward mobility of the middle class in China, or increased self-empowerment of women in the US, consumers look to symbols to demonstrate their status and the fact they belong to the new order. Diamonds signal this very effectively. Empowerment equates to being strong, authentic, unique - all qualities that diamonds have. And this is one of the things that makes ‘Real is Rare. Real is a diamond’’ a powerful new platform. It gives them meaning beyond the celebration of relationship moments to the celebration of personal growth.

Some well-known brands are already tapping into the potential of this territory very effectively. For example this year, Tiffany launched their campaign “There’s only one you,” starring Zoe Kravitz, Elle Fanning, and Janelle Monae among others. De Beers “Moments in Light” campaign showcases talented women who share their stories. It’s a space with plenty of room to grow. 76% of women globally say that brands do not currently represent them. 74% say they wished they had more female models to inspire them when they were growing up.

Image Credit: tiffany.com

Image Credit: tiffany.com

YN: How about the geographical particulars of the diamond distribution and consumer trends?

MP: The US is still the most important market for polished diamonds with over 51% of sales. And it is growing at approximately 4% YOY. If we talk about other markets, for example, China, that’s where there is most potential because of a growing middle class. From 2006 to 2016 the sales of diamonds in China tripled and the image of diamonds is even stronger than in the US. Chinese millennials also still take their fashion cues from the west so high-end non-bridal jewelry from designer brands is likely to grow.

India, though relatively small with 4% of global market share has got a lot of potential as well. It has always been a huge gold market, fueled by weddings. Gold is viewed as auspicious and acts as an insurance as it can be sold in times of financial difficulty. As Indians come to appreciate the investment value of diamonds, they are likely to buy them for weddings.

A western style engagement ring is also a symbol of a precious and intimate relationship. It contrasts to gold associated with the power and status of the extended families.

YN: So, would it be logical to assume, it is natural for a diamond producing company to first establish itself in the western world and move on to branch out to developing economies?

MP: Yes, I think most brands would start in Western markets. The US is the largest market for luxury and the most accessible for newcomers. China has big potential but there are more regulatory, cultural and legal hurdles around starting businesses. That makes it more complicated and it takes a longer to start a company there. The social media landscape is also very different with different companies dominating. So it’s quite a different world, and you need local expertise to navigate the environment.

A distinct advantage of starting out in the US or Europe is that the luxury trends in China are taken from these markets and brought by wealthier Chinese who are exposed to brands when they go abroad. Getting established in the US gives you the credibility so that when you distribute in China you are already seen as aspirational among the top tier of society.

YN: What makes a great jewelry brand? Maybe there exist some unique parameters?

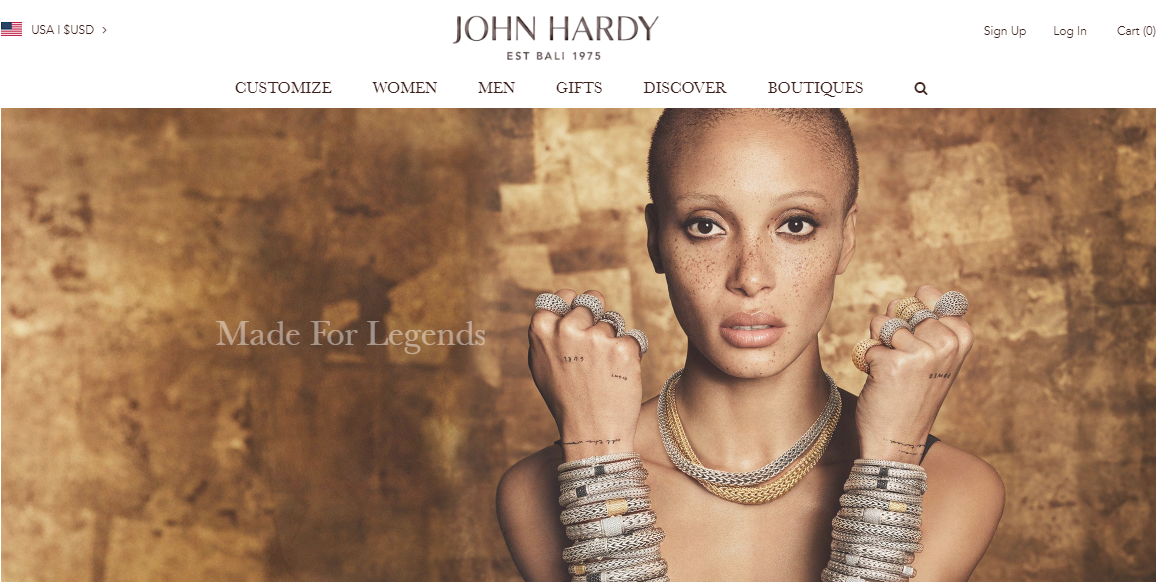

MP: The first thing is a strong and consistent product design and a point of view. This makes the brand recognizable and gives it a unique story. Take John Hardy, for example. Their jewelry is very much based on Bali and it is full of natural references. The pieces are entirely recognizable because of design, quality, and finish. Those elements, when combined, create a truly unique offering. The supporting imagery is exotic, natural, powerful and feminine.

Image: johnhardy.com

Image: johnhardy.com

And take Cartier. Look at the use of the screw in the design of their “LOVE” bracelets or the nail in their “Juste Un Clou” collection. Those are signature iconic motifs which stand the test of time and offer a glimpse of fascinating stories about the heritage of the brand.

Tiffany came up with the key collection, symbolic of holding the key to someone’s heart. For jewelry, these symbols and design motifs are fundamental because they help create emotional meaning as well as instant recognition.

And for the Millennial generation, that sense of belonging to the brand, that they are a part of its world and share its values is also crucial. So it’s important to create design features that are consistent across the range and also make sure there is a set of clearly expressed values behind the brand.

The other key thing is the quality of the artisanship and the authenticity of the production process. Quality extends beyond the product to the imagery to the purchase experience and the way that the brand interacts with the consumer at events. Louis Vuitton supports apprenticeships through their ‘Metiers’ program, ensuring the transmission of savoir-faire to the next generation. And they use this to build content that emphasizes their craft credentials.

Consumers increasingly look for this authenticity. So artisanship has to be at the core of the brand DNA, and communication has to constantly make references that imply quality and creativity. This extends to the partnerships that brands choose such as charities and celebrities.

YN: What dynamics does sustainability as business philosophy show in diamond production?

MP: I think sustainability is a vital part of the industry and it is allied to transparency. Brands have to know where their product is being sourced and how it is being handled along the supply chain. They need to have safeguards to ensure that the raw materials they use are not contributing to conflict or being used to launder money.

The Kimberley process was a big step in the elimination of conflict diamonds. But organizations such as the Responsible Jewellery Council have also helped improve the management of the supply chain over the last decade by certifying companies from mine to market. Moreover, there are many responsible sourcing protocols that are now used by retailers and manufacturers to ensure that their suppliers are acting responsibly. Signet’s SRSP protocol is one such example.

Sustainable practices also have to be built right into the heart of the process of production for a branded product and not just involve a contribution to a charity. Consumers are better educated now and are looking for a deeper involvement in these areas.

The Jewelry Industry Summit also does annual conferences that support initiatives to help the industry become more sustainable and provides strong educational content for any brands that want to get more involved in this critical area. www.jewelryindustrysummit.com

YN: How about the digital era? Is it impacting the diamond luxury segment? What is important for a good representation of a jewelry brand online?

MP: Digital is impacting luxury brands as much as any other sector, perhaps more so. Luxury was initially resistant to online marketing because the sector felt that consumers would want to see, touch, and buy a luxury good in a store. This is important because the values of a brand are best communicated through an in-store immersive experience. Things are changing a lot however with the realization that most research is done online even if more than 80% plus of the final purchases are offline.

The main threat to online brands are the big online jewelry retailers, in particular, those that allow fast price comparison of diamonds such bluenile.com and jamesallen.com. They now have better technology so you can see the diamonds in high res with 360-degree views.

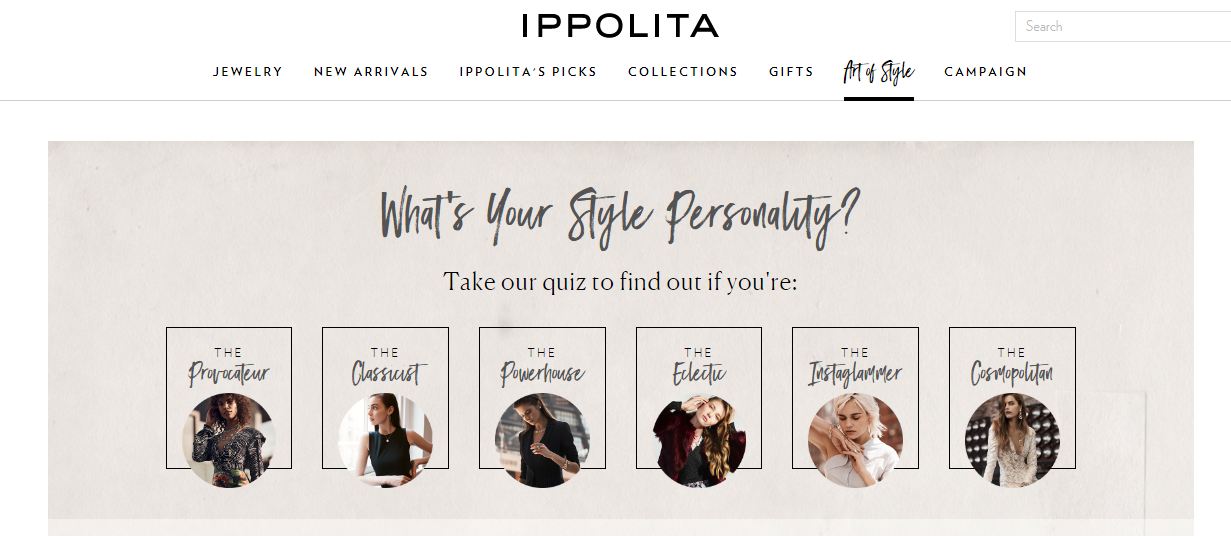

Brands need to respond by creating a more intimate experience, where the lifestyle of the brand and its values are brought to life through stories. Ippolita.com, for example, allows shopping by a particular look that the customer identifies with.

Image source: ippolita.com

Image source: ippolita.com

It’s important that the online presence communicates the personality of the brand and creates a sense of connection. A great way of doing this is to feature designers at work in their studios or in the places that inspire them. We did this with ‘Love Gold,’ an online community featuring exceptional gold jewelry curated by celebrities and bloggers. The videos helped communicate a sense of the designer’s personality, world, and artistic passion. According to a 2017 L2 study, interactions with video accounted for 78% of all online interactions.

A second key factor is ensuring that the brand communicates not just through a website but through social media channels and in particular Instagram. L2 identified that 18% of online interactions for watch and jewelry brands take place on Instagram, far more than Facebook or Twitter.

Thirdly, if you are not offering e-commerce, it’s important to sell collections through sites like net-a-porter where there is a large amount of traffic. The collections sold there can be exclusive to the site to avoid undercutting your own wholesale distribution through independents.

Overall brands can carve out good niche positions online. But they have to really know who they are targeting and create a loyal base of followers. That’s why social media is crucial. Without a presence on social media to keep engaging consumers on a regular basis, a brand can easily remain invisible even if it has a beautiful website.

If you like our Luxury Interviews, please feel free to comment, like & share.

We would also love to hear which marketing gurus you would like us to reach out. Send us your candidate & questions. We will do our best to speak to your coveted expert in the field of luxury marketing, so we all learn from the best.

View Comments